The Top Challenges for Human Resources

Staffing has always been a top challenge for human resources departments. From the Great Resignation to the mental health issues to increased feelings of burnout, all companies have been feeling the pressure to attract and retain top talent. Explore the top challenges for human resources departments and how Eli Advisors can help! Strategies & Tactics […]

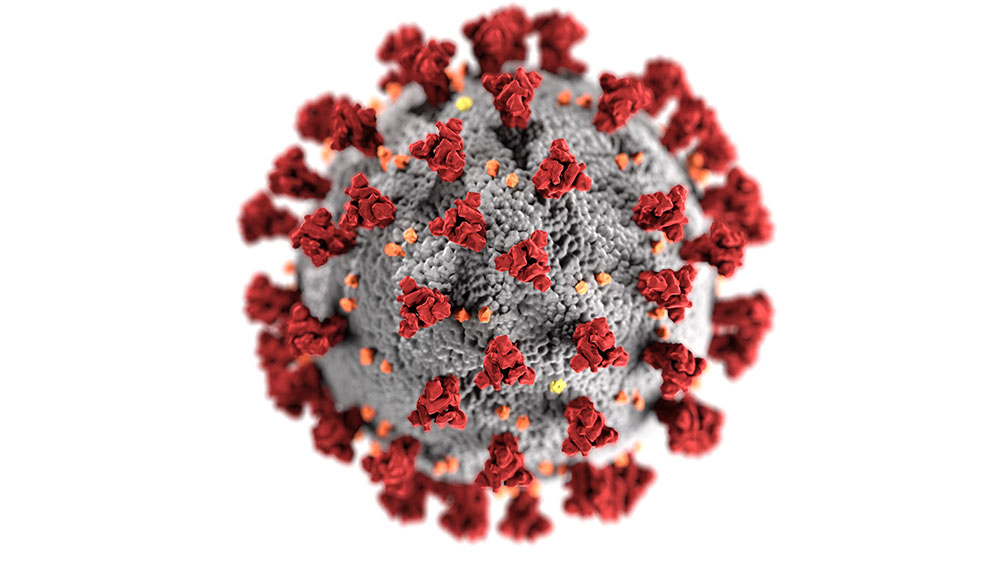

How to Create a COVID-19 Workplace Policy

Two years in, and COVID-19 continues to impact businesses and employees, and not for the better. The Pew Research Center reports that less than half of employees are satisfied with the steps their employers have taken to keep them safe from COVID-19. With continuous changes in policies and regulations, it can be hard for a small business […]

IRS Releases 2023 HSA Index Figures

IRS releases 2023 Health Savings Account (HSA) index figures and the maximum amount that may be made newly available for the plan year in an excepted Health Reimbursement Arrangement (HRA). The Internal Revenue Service (IRS) recently released the new HSA index figures for 2023 and additional guidance on the tax treatment of dependent care benefits. […]

Employee Benefits Solutions that Won’t Break Your Budget

One of the biggest concerns of any business owner is the budget as it helps to ensure both you and your employees are taken care of, is a measure of growth and success, and is essential for business success. Often over 25% of a company’s budget dedicated to employee benefits. It can be easy to try […]

Transparency in Coverage Rule: Impact On Your Business

New Transparency in Coverage Rule for 2022 The Transparency in Coverage Rule will come into effect on July 1, 2022. The rule was passed by the US Department of Health & Human Services, the Department of Labor, and the Department of Treasury in 2020. The rule outlines that all health insurers and group health plans […]

New CDC Isolation and Quarantine Guidelines

The new CDC Isolation and Quarantine Guidelines certainly help get workers back sooner, but the CDC admits it is a combination of science and business need. So employers should carefully consider whether implementing the more aggressive return to work protocols are right given their situation. CDC Isolation and Quarantine Guidelines If You Test Positive for […]

Federal Extension of Form I-9: Flexibility Into 2022

The U.S. Immigration and Customs Enforcement (ICE) has passed a Federal Extension of Form I-9 compliance flexibility until April 30, 2022, due to necessary COVID-19 precautions. This extension continues to apply the guidance previously issued for employees hired on or after April 1, 2021, and who work exclusively in a remote setting due to COVID-19-related […]

New Jersey Minimum Wage Increases: Compliance Reminder

On January 1, 2022, the minimum wage for most employers in New Jersey will increase to $13.00 per hour. For seasonal and small employers (those with five or fewer employees), the minimum wage will increase to $11.90 per hour. Agricultural employers must pay at least $10.90 per hour. Employees who provide direct care at a […]

IRS Announces Changes to Retirement Plans for 2022

Next year taxpayers can put an extra $1,000 into their 401(k) plans. The IRS recently announced that the 2022 contribution limit for 401(k) plans will increase to $20,500. The agency also announced cost‑of‑living adjustments that may affect pension plan and other retirement-related savings next year. Highlights of Changes to Retirement Plans for 2022 The contribution […]

2022 Health FSA Contribution Cap Rises to $2,850

In 2022, the Health FSA contribution cap will rise, impacting all businesses in New Jersey. Employees can put an extra $100 into their health care flexible spending accounts (health FSAs) next year, the IRS announced on Nov. 10, as the annual contribution limit rises to $2,850, up from $2,750. But with open enrollment for the […]